Denver Wealth Advisors

Skilled Financial & Wealth Advisors You Can Depend On

If you don’t have an in-depth plan for retirement, it can leave you feeling overwhelmed and directionless. At Denver Wealth Advisors we’re passionate about providing excellent retirement and wealth planning services to help our clients prepare for the future, and we want to do the same for you. Whether you need assistance navigating estate planning or maximizing social security, our firm is here for you.

We take an adaptable approach to financial services, offering support over the phone, through video calls, or in person. Our office is conveniently located at the corner of S. Colorado Blvd. and E. Ohio Ave. Contact us today to schedule your free initial consultation with one of our financial planners!

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

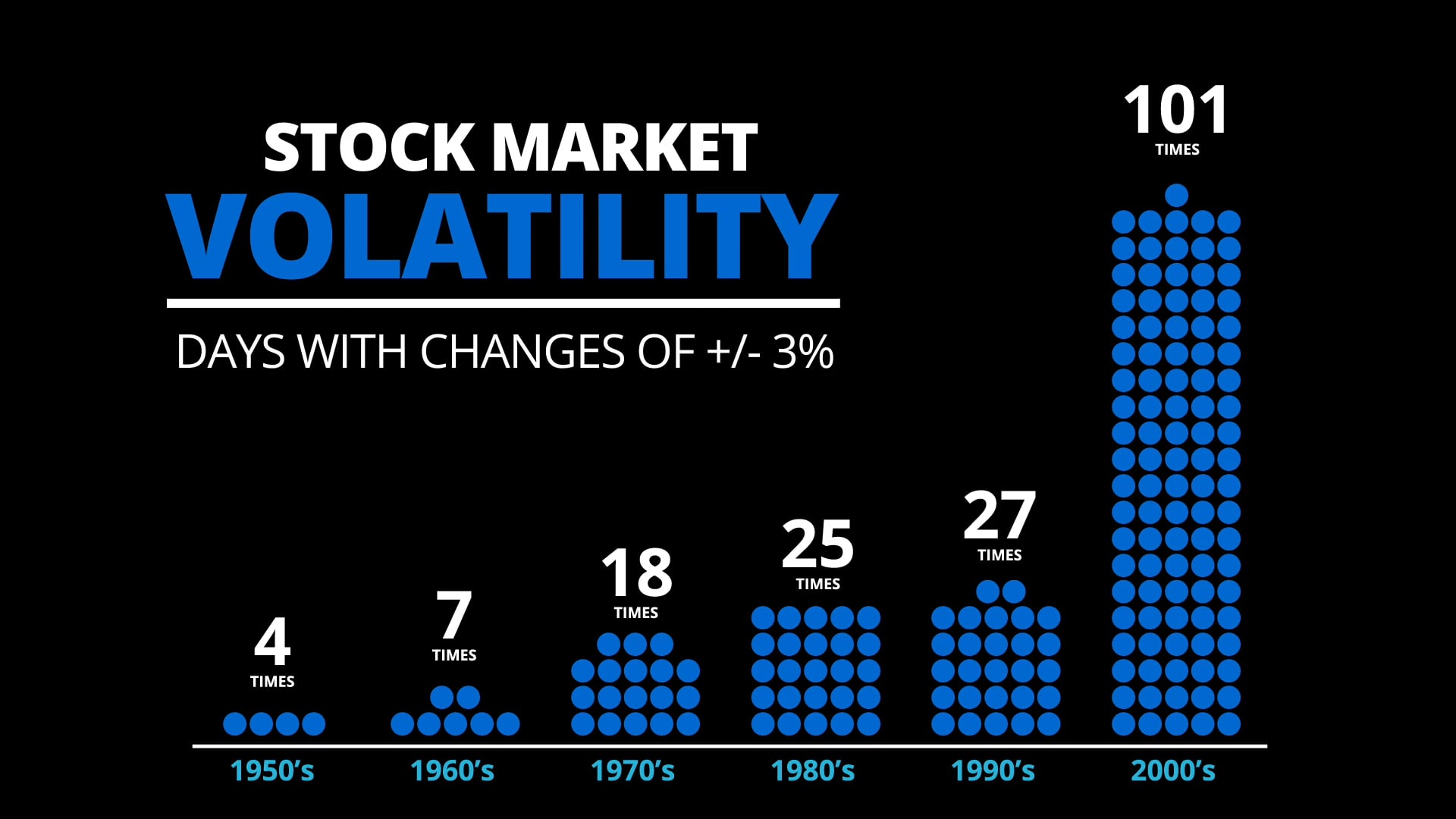

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Meet Aaron Hersch

Here For You

Aaron Hersch

Principal Advisor

Aaron Hersch is a principal advisor at Denver Wealth Advisors, LLC, a boutique, independent financial planning and investment advisory firm serving the Denver metropolitan and Front Range areas. Aaron is a Certified Financial Planner TM (CFP®), a Certified Public Accountant (CPA), and holds the AICPA-PFS (Personal Financial Planning Specialist) designation from the American Institute of Certified Public Accountants. He has also been awarded a Master’s Degree in Personal Financial Planning; providing a combination of training, experience, and skills which are extremely rare among financial advisors. Drawing from a wide range of disciplines, Aaron is better able to offer integrated advice for clients precisely tailored to their unique circumstances.

Aaron recognizes that the transition to retirement is an uncertain time for many and works diligently to develop a structured retirement financial plan for clients; a plan that can withstand and minimize risks to market losses while providing a reliable source of income during retirement years. He simplifies clients’ complex financial lives by coordinating the efforts of a variety of professionals, including accountants and attorneys. Aaron is a trusted advisor who plays a key role in the ongoing financial lives of his clients. His goal is to provide each one with the peace of mind that comes with knowing that they have properly planned for retirement and can enjoy what is really important to them in their retirement years.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Events in February–April 2026

- There are no events scheduled during these dates.

Our Downloads

Why 59 ½ Is An Important Age

How to Plan for This Upcoming Milestone

The road to a strong retirement starts long before your last paycheck. This guide is packed with smart, age-specific strategies for ages 5 to 55, from building savings habits early to planning for college and maximizing your working years. The earlier you start, the greater your opportunities to grow, save, and thrive.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.